This Penny Stock Almost Doubled on Plans to Buy Bitcoin and Ethereum. Should You Buy Its Shares Now?

Cryptocurrency-linked penny stocks have become some of the most explosive trades lately. Many small-cap firms are adopting Bitcoin (BTCUSD) and Ethereum (ETHUSD) treasury strategies to attract investors, a move pioneered by Strategy (MSTR) (formerly MicroStrategy) and now followed by a growing list of Nasdaq-listed names.

One of the latest entrants is Mogu (MOGU), a Chinese online fashion company that just announced plans to allocate $20 million into Bitcoin, Ethereum, and Solana (SOLUSD). With this pivot, Mogu is positioning itself not just as a digital fashion player but also as a potential crypto treasury stock, blending e-commerce with digital assets in a way that could capture investor enthusiasm.

So, with momentum building and MOGU stock suddenly back on traders’ radars, should you consider buying shares now?

MOGU Stock Surges on Crypto Treasury Pivot

Last week, Chinese fashion e‑commerce firm Mogu announced a dramatic shift in strategy, approving a plan to allocate up to $20 million of its corporate assets into cryptocurrencies. The board unanimously backed purchases of Bitcoin, Ethereum, and Solana, aiming to “diversify its treasury holdings” and bolster resources for future AI‑driven initiatives.

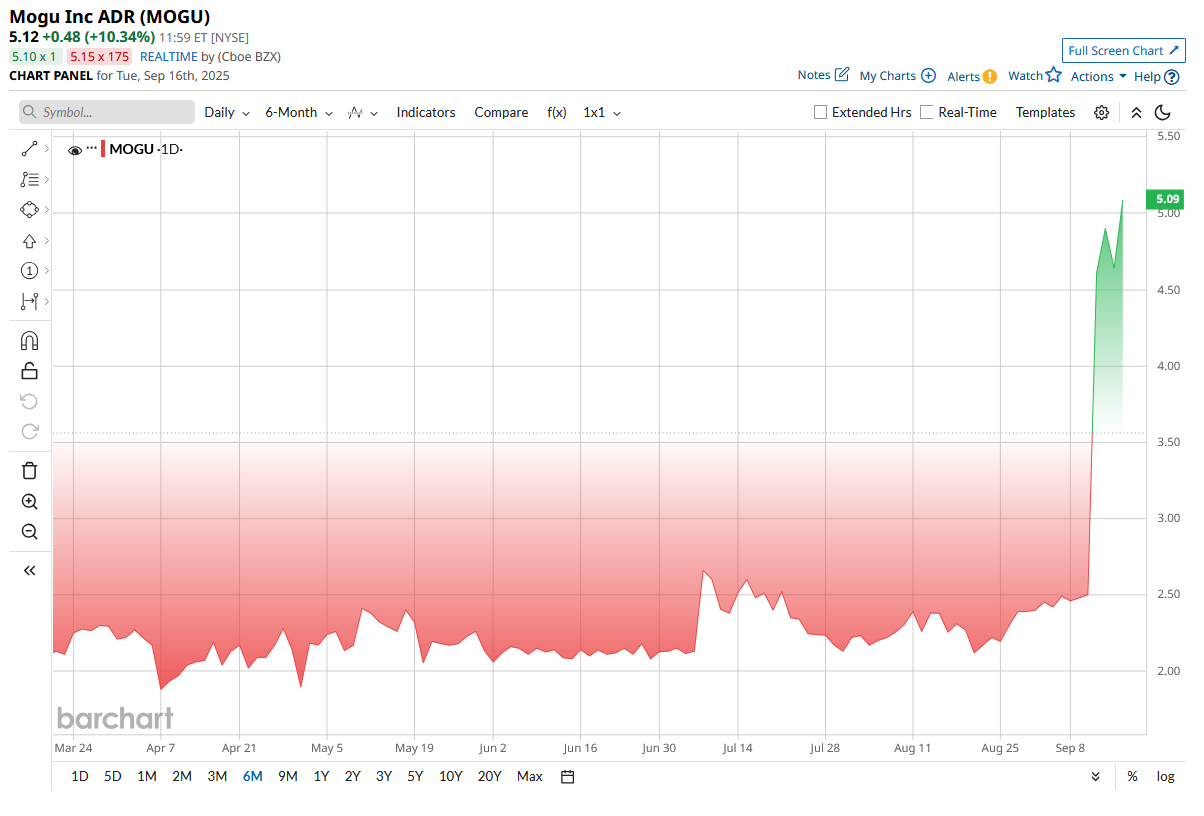

The announcement effectively transforms Mogu into a “digital asset treasury” (DAT) play, joining a wave of companies that are adding crypto to their balance sheets. News of the pivot triggered a frenzied rally. MOGU shares exploded more than 75%, jumping from roughly $4.4 to over $7.30.

MOGU stock hit multi-year highs after unveiling its crypto treasury plan, soaring about 120% intraday before settling near mid-$5, well above early-2025 levels. The stock was already up 113% year-to-date (YTD). Trading surged to 27 million shares, far beyond typical volume, as investors bet on crypto-driven treasury gains.

Mogu's Financial Overview

Mogu’s pivot comes against a backdrop of a struggling core business. In its latest filings for the fiscal year that ended March 31, 2025, Mogu reported roughly RMB141.2 million in revenue (about $19.5 million), down nearly 12% from the prior year.

Mogu reported a net loss of RMB62.6 million ($8.6 million) for FY2025, up from RMB59.3 million a year earlier. Its operating loss widened to RMB101.1 million ($13.9 million). The company’s gross merchandise volume (GMV), a key measure of its social-commerce platform, fell nearly 29% in the second half of FY2025 compared with the same period last year. Tougher competition and weaker user engagement drove that decline. Some areas, such as technology services, grew 54% year-over-year (YoY), but those gains did not make up for the drop in the core commission-based business.

On the balance sheet, however, MOGU is in a surprisingly strong liquidity position for a penny stock. The company held about RMB380.1 million in cash, equivalents, and short‑term investments as of March 31, 2025, roughly $52.4 million. It had essentially no long‑term debt, giving it a net cash position of over $50M. This ample cash cushion means Mogu can fund the $20 million crypto plan without drawing on external financing or leverage. Indeed, analyst services note a net cash per share of over $6.

The Bottom Line

The transition into crypto made MOGU stock skyrocket and helped keep the stock at higher points than ever before in 2025. If Bitcoin and Ethereum increase, their treasuries can improve by millions of dollars, and their influencer packages can gain access to AI and blockchain. But risks remain. A crypto crash would be detrimental, and the main business of Mogu has been experiencing declining income and hard competition in China. Crypto does not resolve poor fundamentals but does make them exciting. The rally can die off unless there is a proper increase in earnings. Investors ought to remain wary: the stock is speculative, subject to crypto swings, and will tend to decline should its e-commerce issues continue to affect it. Close attention should be paid.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.