This Flying Car Stock Just Got a White House Boost. Should You Buy Its Shares Here?

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Joby Aviation (JOBY) is a leading developer of electric vertical takeoff and landing (eVTOL) aircraft, committed to revolutionizing urban air mobility for both passengers and goods. The company collaborates with industry giants like Toyota (TM) and Delta Air Lines (DAL) while holding strategic partnerships with NASA and the U.S. Air Force. Joby is rapidly advancing toward FAA certification and large-scale production, positioning itself as a pioneer in the future of sustainable air transportation.

Established in 2009, the company is headquartered in California with operations running globally.

JOBY Stock Shines

JOBY stock has demonstrated remarkable volatility in 2025, surging over 7.2% in the past five days and posting a negative 13.4% return for the month as profit-taking followed its recent highs. Despite the short-term correction, shares have gained 130.6% over six months, up 77% year-to-date (YTD), and an impressive 170% in the past year, reflecting investor optimism.

Joby Aviation Disappoints

Joby Aviation delivered disappointing Q2 2025 financial results that fell significantly short of market expectations. The electric air taxi developer posted an earnings per share loss of $0.41, considerably worse than the analyst consensus estimate of $0.19. Quarterly revenue totaled just $15,000, missing the consensus forecast of $43,000 by a substantial margin and marking a 46% decline from the previous year.

Financial performance deteriorated across key metrics, with net losses ballooning to $324.7 million, representing a 163% increase compared to Q2 2024. Total operating costs climbed 16% year-over-year (YoY), primarily due to escalating research and development expenditures that jumped 20.7%.

Despite these challenges, Joby maintained a robust financial position, with $991 million in cash and short-term investments, bolstered by a $250 million investment from Toyota. The company achieved important operational milestones, including 70% completion of Stage 4 FAA certification and successful flight-testing campaigns in Dubai.

Looking ahead, Joby maintained its full-year cash burn guidance of $500-$540 million for 2025, excluding potential impacts from the proposed Blade Air Mobility acquisition. Management emphasized their focus on production scaling, regulatory approvals, and strategic partnerships to drive commercialization efforts.

Joby Aviation Invited to White House

Joby announced its participation in the White House’s new eVTOL Integration Pilot Program (eIPP), a federal initiative intended to accelerate the deployment of electric vertical takeoff and landing aircraft in the United States.

Established by a recent executive order, the program directs the Department of Transportation and FAA to allow “mature” eVTOL designs like Joby’s to begin limited operations in select markets before receiving full FAA certification. This aims to fast-track the safe integration of air taxis for passenger transport, cargo delivery, and emergency response.

Joby is confident in its qualification for the eIPP, citing its advanced stage in FAA certification and scalable manufacturing capabilities. The company has accumulated over 40,000 miles of flight testing, completed milestone flights, and demonstrated operational reliability across diverse environments. Chief Policy Officer Greg Bowles emphasized Joby’s commitment to launching services in communities nationwide, leveraging over 15 years of technological development.

The eIPP requires selected partners, such as Joby, to participate in at least five pilot projects, showcasing readiness for commercial flights in real-world settings. With this program, Joby aims to demonstrate its aircraft’s maturity and pave the way for safe and legal eVTOL operations across U.S. cities ahead of a broader commercial rollout.

Should You Bet on JOBY?

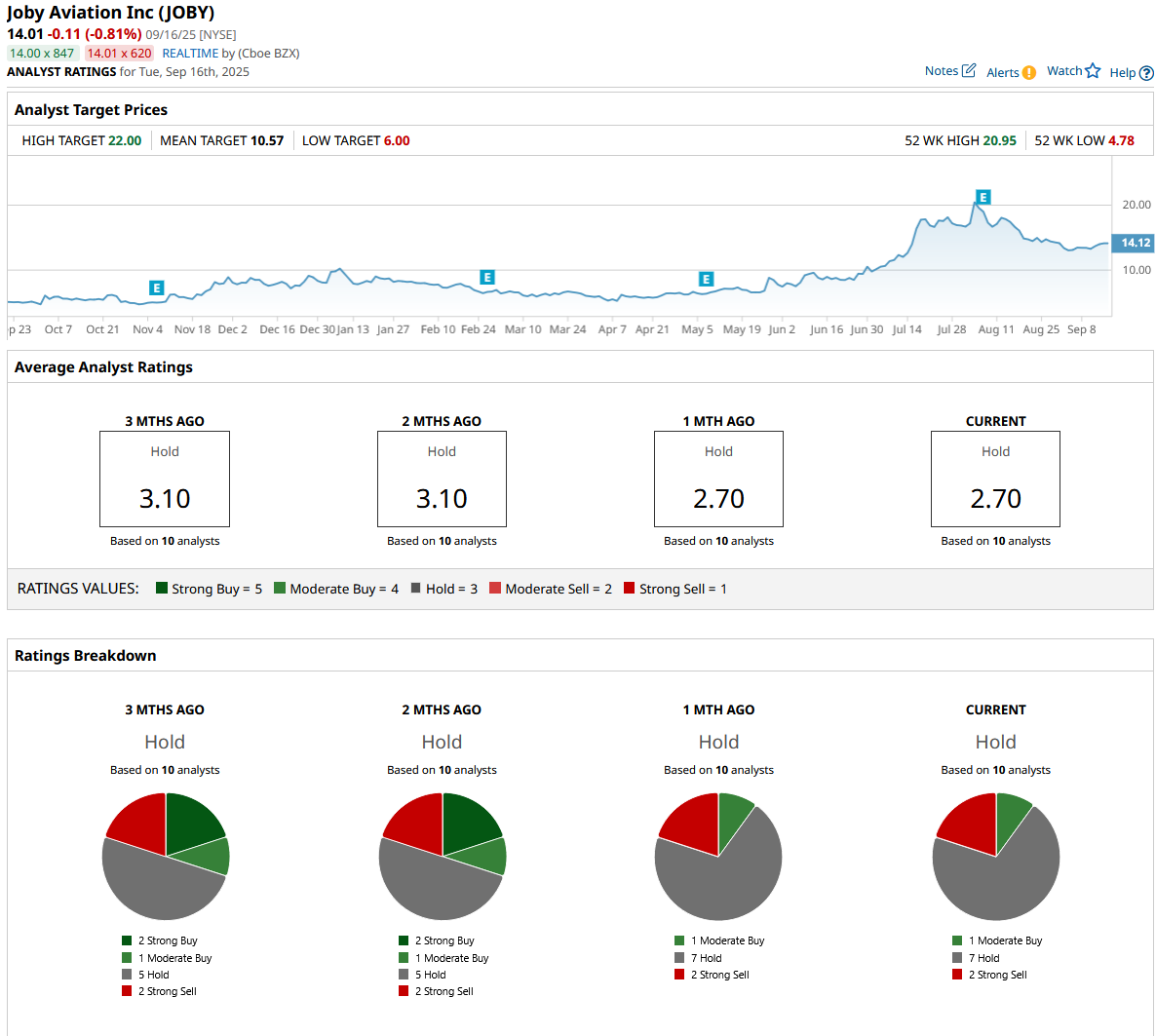

Analysts appear to be running low on patience with Joby Aviation, as JOBY stock has received a consensus “Hold” rating on Wall Street, accompanied by a mean price target of $10.57, which is below the market rate, resulting in a potential 25% downside from current levels.

JOBY stock has been rated by 10 analysts, receiving one “Moderate Buy” rating, seven “Hold” ratings, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.